(This post has been updated as of January 21, 2023.)

Full Disclosure: I am NOT a tax professional. But I did minor in accounting and took a few tax courses in college, and I have an MBA. I have also been an Avon Representative for the past six years, and have had another sole proprietorship business for 14 years.

In this post, I will attempt to shed some light on what new Avon Representatives need to start thinking about to save themselves a lot of anxiety at the end of the year.

During the first few months of every year, I see many Avon Representatives asking questions about taxes in our Facebook groups. And I see a lot of wrong answers being given by other Representatives. I’m going to give general common-sense advice here, but you need to consult a tax professional with specific questions about your business and taxes. My aim is just to get you thinking ahead so you’ve got it all together when tax time comes.

Rule No. 1: Do NOT wait until the end of the year to start thinking about taxes!

Why? Because you should begin keeping records on Day One. The day you sign up to be an Avon Representative is when you should start keeping records. Get into this habit NOW. As a business owner, you are responsible for keeping accurate records of your business transactions. It is not Avon’s responsibility. Whether you use QuickBooks, a spreadsheet, a notebook, or a shoebox, you need to keep track of every cent that goes in or out of your business. Yes, it’s extra work now. But think about trying to re-create everything you did for a whole year next February. Believe me, you will be glad you did. No one is going to help you if you didn’t keep records.

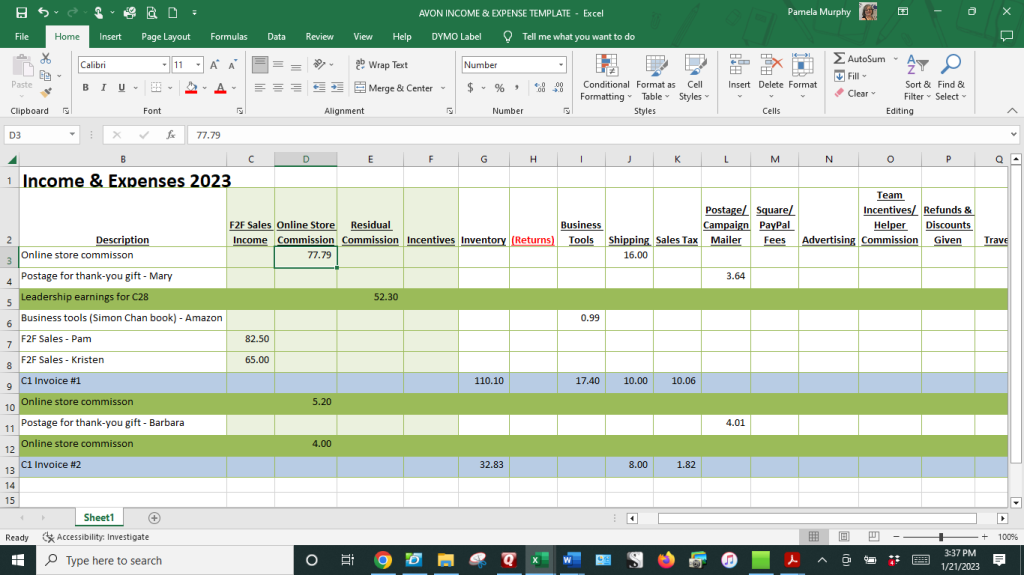

“Overkill” is my middle name. I actually keep a detailed Excel spreadsheet, and I record everything in Quicken as well because I use Quicken for all my personal finances and both businesses. But the spreadsheet I use for each business has everything for that business together, and it’s easy to analyze without pulling reports from Quicken. I record my transactions in both places literally as soon as they occur or as soon as I get home. But you do you. As long as you keep records and can retrieve them when needed, you’re in good shape.

Here are some of the things you need to keep detailed records of:

Income:

- Face-to-face sales income

- Online (direct delivery) sales commission

- Leadership earnings

- Incentives earned (cash bonuses, and the value of prizes, trips, etc.)

Expenses:

- Inventory purchased for resale

- Business tools (including brochures, bags, samples, labels, copier paper and toner, business cards, etc.)

- Shipping fees for your orders

- Postage for items mailed, brochures mailed, thank-you notes, etc.

- Fees charged to you by Square, PayPal, Venmo, etc., if you use these services

- Advertising costs (including vendor show fees)

- Business travel and meals (to attend Avon Convention, meetings, etc.)

- Mileage for your car when you make deliveries (you’ll also need to write down your beginning and ending mileage for the year)

Basically, everything related to your Avon business needs to be recorded and documented. You can use accounting software like Quicken, a spreadsheet, or even a notebook. Just make sure to record all transactions as soon as possible after they occur. Here is an Excel spreadsheet template that you can use to start your own. I have left a few transactions in there so you can see how I keep track. Click on the link below the screenshot to download it.

Rule No. 2: You are a Business Owner – Not an Employee

This means, you do NOT get a W-2 form from Avon. You MAY get a 1099 form if you meet certain criteria, such as purchasing $5,000 worth of merchandise in the year and/or having leadership earnings or bonuses. Avon does not withhold any taxes from your income.

But, regardless of whether or not you receive a 1099 form, you must file an income tax return if your net earnings from self-employment were $400 or more (in 2021). If your net earnings from self-employment were less than $400, you may still have to file an income tax return if you meet any other filing requirement listed in the Form 1040 instructions.

If you have kept a detailed spreadsheet throughout the year, all you need to do is total all your columns and take everything to your tax professional, or if you’re doing your own taxes (kudos to you), plug the numbers into the appropriate lines on Schedule C and voilà! Easy peasy. If you’re using tax software such as H&R Block or TurboTax, it will walk you right through all of this.

Rule No. 3: Don’t rely on your Avon invoices for tax information

Avon has no idea why you’re buying products. Maybe they’re for your own personal use, or for giving as gifts to family or friends. Your invoice is basically just a list of what you ordered. You need to go through each invoice and mark off which items were personal purchases, subtracting them from your inventory spend.

As far as deductible expenses, see that list of expenses above? Most of them are not on your invoice. Did you buy supplies to make holiday baskets at Dollar Tree? Do you send thank-you notes to online customers? Save those receipts and record them! Get into the habit NOW, and you won’t be panicking later.

End of rant. I wish you the very best with your new business!